Page 11 - I-78-Logistics-Park-OM-v4a

P. 11

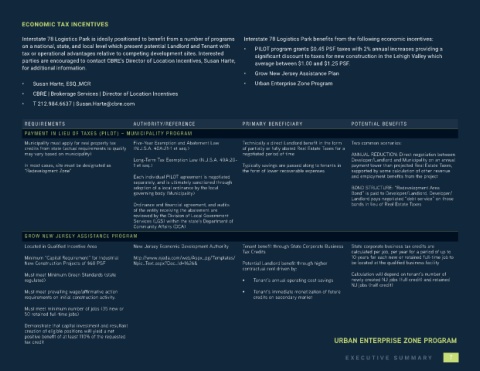

ECONOMIC TAX INCENTIVES

Interstate 78 Logistics Park is ideally positioned to benefit from a number of programs Interstate 78 Logistics Park benefits from the following economic incentives:

on a national, state, and local level which present potential Landlord and Tenant with • PILOT program grants $0.45 PSF taxes with 2% annual increases providing a

tax or operational advantages relative to competing development sites. Interested significant discount to taxes for new construction in the Lehigh Valley which

parties are encouraged to contact CBRE’s Director of Location Incentives, Susan Harte, average between $1.00 and $1.25 PSF.

for additional information.

• Grow New Jersey Assistance Plan

• Susan Harte, ESQ.,MCR • Urban Enterprise Zone Program

• CBRE | Brokerage Services | Director of Location Incentives

• T 212.984.6637 | [email protected]

REQUIREMENTS AUTHORITY/REFERENCE PRIMARY BENEFICIARY POTENTIAL BENEFITS

PAYMENT IN LIEU OF TAXES (PILOT) – MUNICIPALITY PROGRAM

Municipality must apply for real property tax Five-Year Exemption and Abatement Law Technically a direct Landlord benefit in the form Two common scenarios:

credits from state (actual requirements to qualify (N.J.S.A. 40A:21-1 et seq.) of partially or fully abated Real Estate Taxes for a

may vary based on municipality) negotiated period of time ANNUAL REDUCTION: Direct negotiation between

Long-Term Tax Exemption Law (N.J.S.A. 40A:20- Developer/Landlord and Municipality on an annual

In most cases, site must be designated as 1 et seq.) Typically savings are passed along to tenants in payment lower than projected Real Estate Taxes,

“Redevelopment Zone” the form of lower recoverable expenses supported by some calculation of other revenue

Each individual PILOT agreement is negotiated and employment benefits from the project

separately, and is ultimately sanctioned through

adoption of a local ordinance by the local BOND STRUCTURE: “Redevelopment Area

governing body (Municipality) Bond” is paid to Developer/Landlord. Developer/

Landlord pays negotiated “debt service” on those

Ordinance and financial agreement, and audits bonds in lieu of Real Estate Taxes

of the entity receiving the abatement are

reviewed by the Division of Local Government

Services (LGS) within the state’s Department of

Community Affairs (DCA)

GROW NEW JERSEY ASSISTANCE PROGRAM

Located in Qualified Incentive Area New Jersey Economic Development Authority Tenant benefit through State Corporate Business State corporate business tax credits are

Tax Credits calculated per job, per year for a period of up to

Minimum “Capital Requirement” for Industrial http://www.njeda.com/web/Aspx_pg/Templates/ 10 years for each new or retained full-time job to

New Construction Projects of $60 PSF Npic_Text.aspx?Doc_Id=1626& Potential Landlord benefit through higher be located at the qualified business facility

contractual rent driven by:

Must meet Minimum Green Standards (state Calculation will depend on tenant’s number of

regulated) • Tenant’s annual operating cost savings newly created NJ jobs (full credit) and retained

NJ jobs (half credit)

Must meet prevailing wage/affirmative action • Tenant’s immediate monetization of future

requirements on initial construction activity. credits on secondary market

Must meet minimum number of jobs (35 new or

50 retained full-time jobs)

Demonstrate that capital investment and resultant

creation of eligible positions will yield a net

positive benefit of at least 110% of the requested

tax credit URBAN ENTERPRISE ZONE PROGRAM

E x E C UT I v E S UM M A R Y 7

E x E C UT I v E S UM M A R Y