Page 30 - I-78-Logistics-Park-OM-v4a

P. 30

30 EXECUTIVE SUMMARY | LOCATION HIGHLIGHTS | FINANCIAL ANALYSIS | MARKET SURVEY

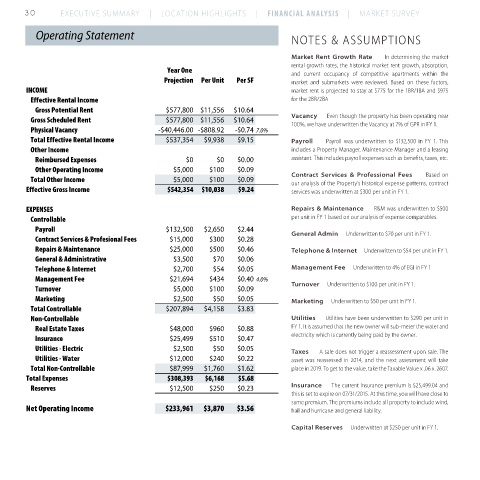

Operating Statement NOTES & ASSUMPTIONS

Market Rent Growth Rate In determining the market

rental growth rates, the historical market rent growth, absorption,

Year One and current occupancy of competitive apartments within the

Projection Per Unit Per SF market and submarkets were reviewed. Based on these factors,

INCOME market rent is projected to stay at $775 for the 1BR/1BA and $975

Effective Rental Income for the 2BR/2BA

Gross Potential Rent $577,800 $11,556 $10.64

Gross Scheduled Rent $577,800 $11,556 $10.64 Vacancy Even though the property has been operating near

100%, we have underwritten the Vacancy at 7% of GPR in FY 1.

Physical Vacancy -$40,446.00 -$808.92 -$0.74 7.0%

Total Effective Rental Income $537,354 $9,938 $9.15 Payroll Payroll was underwritten to $132,500 in FY 1. This

Other Income includes a Property Manager, Maintenance Manager and a leasing

Reimbursed Expenses $0 $0 $0.00 assistant. This includes payroll expenses such as bene"ts, taxes, etc.

Other Operating Income $5,000 $100 $0.09

Total Other Income $5,000 $100 $0.09 Contract Services & Professional Fees Based on

our analysis of the Property’s historical expense patterns, contract

Effective Gross Income $542,354 $10,038 $9.24 services was underwritten at $300 per unit in FY 1.

EXPENSES Repairs & Maintenance R&M was underwritten to $500

Controllable per unit in FY 1 based on our analysis of expense comparables.

Payroll $132,500 $2,650 $2.44 General Admin Underwritten to $70 per unit in FY 1.

Contract Services & Profesional Fees $15,000 $300 $0.28

Repairs & Maintenance $25,000 $500 $0.46 Telephone & Internet Underwritten to $54 per unit in FY 1.

General & Administrative $3,500 $70 $0.06

Telephone & Internet $2,700 $54 $0.05 Management Fee Underwritten to 4% of EGI in FY 1

Management Fee $21,694 $434 $0.40 4.0%

Turnover $5,000 $100 $0.09 Turnover Underwritten to $100 per unit in FY 1.

Marketing $2,500 $50 $0.05 Marketing Underwritten to $50 per unit in FY 1.

Total Controllable $207,894 $4,158 $3.83

Non-Controllable Utilities Utilities have been underwritten to $290 per unit in

Real Estate Taxes $48,000 $960 $0.88 FY 1. It is assumed that the new owner will sub-meter the water and

Insurance $25,499 $510 $0.47 electricity which is currently being paid by the owner.

Utilities - Electric $2,500 $50 $0.05 Taxes A sale does not trigger a reassessment upon sale. The

Utilities - Water $12,000 $240 $0.22 asset was reassessed in 2014, and the next assessment will take

Total Non-Controllable $87,999 $1,760 $1.62 place in 2019. To get to the value, take the Taxable Value x .06 x .2607.

Total Expenses $308,393 $6,168 $5.68

Reserves $12,500 $250 $0.23 Insurance The current Insurance premium is $25,499.04 and

this is set to expire on 07/31/2015. At this time, you will have close to

same premium. The premiums include all property to include wind,

Net Operating Income $233,961 $3,870 $3.56 hail and hurricane and general liability.

Capital Reserves Underwritten at $250 per unit in FY 1.