Page 28 - I-78-Logistics-Park-OM-v4a

P. 28

28 EXECUTIVE SUMMARY | LOCATION HIGHLIGHTS | FINANCIAL ANALYSIS | MARKET SURVEY

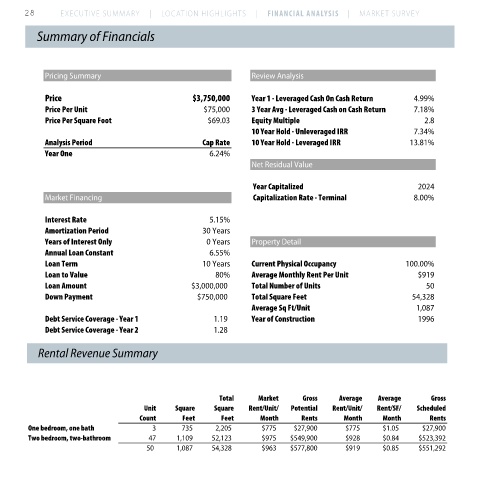

Summary of Financials

Pricing Summary Review Analysis

Price $3,750,000 Year 1 - Leveraged Cash On Cash Return 4.99%

Price Per Unit $75,000 3 Year Avg - Leveraged Cash on Cash Return 7.18%

Price Per Square Foot $69.03 Equity Multiple 2.8

10 Year Hold - Unleveraged IRR 7.34%

Analysis Period Cap Rate 10 Year Hold - Leveraged IRR 13.81%

Year One 6.24%

Year End Jan-Dec 2014 6.34% Net Residual Value

Year Capitalized 2024

Market Financing Capitalization Rate - Terminal 8.00%

Cost of Sale 0.00%

Interest Rate 5.15%

Amortization Period 30 Years

Years of Interest Only 0 Years Property Detail

Annual Loan Constant 6.55%

Loan Term 10 Years Current Physical Occupancy 100.00%

Loan to Value 80% Average Monthly Rent Per Unit $919

Loan Amount $3,000,000 Total Number of Units 50

Down Payment $750,000 Total Square Feet 54,328

Average Sq Ft/Unit 1,087

Debt Service Coverage - Year 1 1.19 Year of Construction 1996

Debt Service Coverage - Year 2 1.28

Rental Revenue Summary

Total Market Gross Average Average Gross

Unit Square Square Rent/Unit/ Potential Rent/Unit/ Rent/SF/ Scheduled

Count Feet Feet Month Rents Month Month Rents

One bedroom, one bath 3 735 2,205 $775 $27,900 $775 $1.05 $27,900

Two bedroom, two-bathroom 47 1,109 52,123 $975 $549,900 $928 $0.84 $523,392

50 1,087 54,328 $963 $577,800 $919 $0.85 $551,292

$1,200 Average vs. Market Rents 60% Two Bedroom Rent Distribution

Bars Represent Market Rent, Lines Represent Market Rent is $975; only 5 units meet or exceed Market Rent.

$1,000

Average Rent 50%

$800

40%

$600

30%

$400

20%

$200

10%

$0

One bedroom, one bath Two bedroom, two- 0%

bathroom

$600 $875 $900 $950 $1,000