Page 35 - I-78-Logistics-Park-OM-v4a

P. 35

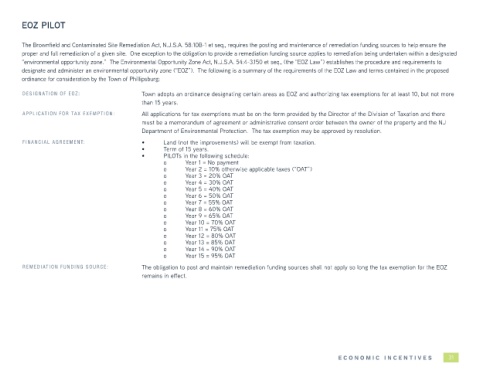

EOZ PILOT

The Brownfield and Contaminated Site Remediation Act, N.J.S.A. 58:10B-1 et seq., requires the posting and maintenance of remediation funding sources to help ensure the

proper and full remediation of a given site. One exception to the obligation to provide a remediation funding source applies to remediation being undertaken within a designated

“environmental opportunity zone.” The Environmental Opportunity Zone Act, N.J.S.A. 54:4-3.150 et seq., (the “EOZ Law”) establishes the procedure and requirements to

designate and administer an environmental opportunity zone (“EOZ”). The following is a summary of the requirements of the EOZ Law and terms contained in the proposed

ordinance for consideration by the Town of Phillipsburg:

DESIGNATION OF EOZ: Town adopts an ordinance designating certain areas as EOZ and authorizing tax exemptions for at least 10, but not more

than 15 years.

APPLICATION FOR TAX EXEMPTION: All applications for tax exemptions must be on the form provided by the Director of the Division of Taxation and there

must be a memorandum of agreement or administrative consent order between the owner of the property and the NJ

Department of Environmental Protection. The tax exemption may be approved by resolution.

FINANCIAL AGREEMENT: • Land (not the improvements) will be exempt from taxation.

• Term of 15 years.

• PILOTs in the following schedule:

o Year 1 = No payment

o Year 2 = 10% otherwise applicable taxes (“OAT”)

o Year 3 = 20% OAT

o Year 4 = 30% OAT

o Year 5 = 40% OAT

o Year 6 = 50% OAT

o Year 7 = 55% OAT

o Year 8 = 60% OAT

o Year 9 = 65% OAT

o Year 10 = 70% OAT

o Year 11 = 75% OAT

o Year 12 = 80% OAT

o Year 13 = 85% OAT

o Year 14 = 90% OAT

o Year 15 = 95% OAT

REMEDIATION FUNDING SOURCE: The obligation to post and maintain remediation funding sources shall not apply so long the tax exemption for the EOZ

remains in effect.

E C O NO MIC I NCE N T I v E S 31