Page 34 - I-78-Logistics-Park-OM-v4a

P. 34

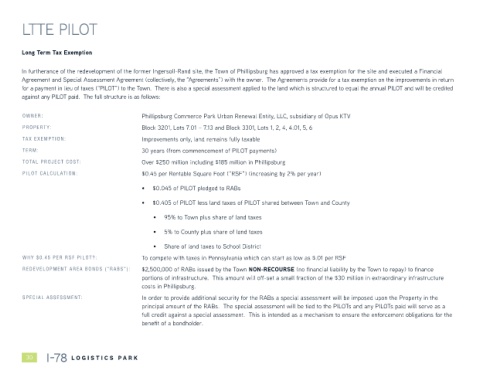

LTTE PILOT

Long Term Tax Exemption

In furtherance of the redevelopment of the former Ingersoll-Rand site, the Town of Phillipsburg has approved a tax exemption for the site and executed a Financial

Agreement and Special Assessment Agreement (collectively, the “Agreements”) with the owner. The Agreements provide for a tax exemption on the improvements in return

for a payment in lieu of taxes (“PILOT”) to the Town. There is also a special assessment applied to the land which is structured to equal the annual PILOT and will be credited

against any PILOT paid. The full structure is as follows:

OWNER: Phillipsburg Commerce Park Urban Renewal Entity, LLC, subsidiary of Opus KTV

PROPERTY: Block 3201, Lots 7.01 – 7.13 and Block 3301, Lots 1, 2, 4, 4.01, 5, 6

TAX EXEMPTION: Improvements only, land remains fully taxable

TERM: 30 years (from commencement of PILOT payments)

TOTAL PROJECT COST: Over $250 million including $185 million in Phillipsburg

PILOT CALCULATION: $0.45 per Rentable Square Foot (“RSF”) (increasing by 2% per year)

• $0.045 of PILOT pledged to RABs

• $0.405 of PILOT less land taxes of PILOT shared between Town and County

• 95% to Town plus share of land taxes

• 5% to County plus share of land taxes

• Share of land taxes to School District

WHY $0.45 PER RSF PILOT?: To compete with taxes in Pennsylvania which can start as low as $.01 per RSF

REDEVELOPMENT AREA BONDS (“RABS”): $2,500,000 of RABs issued by the Town NON-RECOURSE (no financial liability by the Town to repay) to finance

portions of infrastructure. This amount will off-set a small fraction of the $30 million in extraordinary infrastructure

costs in Phillipsburg.

SPECIAL ASSESSMENT: In order to provide additional security for the RABs a special assessment will be imposed upon the Property in the

principal amount of the RABs. The special assessment will be tied to the PILOTs and any PILOTs paid will serve as a

full credit against a special assessment. This is intended as a mechanism to ensure the enforcement obligations for the

benefit of a bondholder.

30 I-78 L O G IS T IC S P A R K