Page 44 - I-78-Logistics-Park-OM-v4a

P. 44

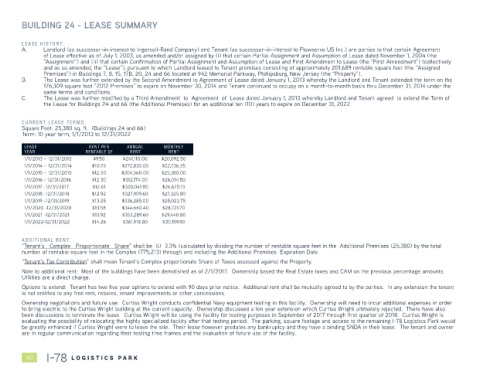

BUILDING 24 - LEASE SUMMARY

LEASE HISTORY:

A. Landlord (as successor-in-interest to Ingersoll-Rand Company) and Tenant (as successor-in-interest to Flowserve US Inc.) are parties to that certain Agreement

of Lease effective as of July 1, 2003, as amended and/or assigned by (i) that certain Partial Assignment and Assumption of Lease dated November 1, 2004 (the

“Assignment”) and (ii) that certain Confirmation of Partial Assignment and Assumption of Lease and First Amendment to Lease (the “First Amendment”) (collectively

and as so amended, the “Lease”), pursuant to which Landlord leased to Tenant premises consisting of approximately 201,689 rentable square feet (the “Assigned

Premises”) in Buildings 7, 8, 15, 17B, 20, 24 and 66 located at 942 Memorial Parkway, Phillipsburg, New Jersey (the “Property”).

B. The Lease was further extended by the Second Amendment to Agreement of Lease dated January 1, 2013 whereby the Landlord and Tenant extended the term on the

176,309 square foot “2012 Premises” to expire on November 30, 2014 and Tenant continued to occupy on a month-to-month basis thru December 31, 2014 under the

same terms and conditions.

C. The Lease was further modified by a Third Amendment to Agreement of Lease dated January 1, 2013 whereby Landlord and Tenant agreed to extend the Term of

the Lease for Buildings 24 and 66 (the Additional Premises) for an additional ten (10) years to expire on December 31, 2022.

CURRENT LEASE TERMS:

Square Feet: 25,380 sq. ft. (Buildings 24 and 66)

Term: 10 year term, 1/1/2013 to 12/31/2022

LEASE RENT PER ANNUAL MONTHLY

YEAR RENTABLE SF RENT RENT

1/1/2013 – 12/31/2013 $9.50 $241,110.00 $20,092.50

1/1/2014 – 12/31/2014 $10.75 $272,835.00 $22,736.25

1/1/2015 – 12/31/2015 $12.00 $304,560.00 $25,380.00

1/1/2016 - 12/31/2016 $12.30 $312,174.00 $26,014.50

1/1/2017 -12/31/2017 $12.61 $320,041.80 $26,670.15

1/1/2018 -12/31/2018 $12.92 $327,909.60 $27,325.80

1/1/2019 -12/31/2019 $13.25 $336,285.00 $28,023.75

1/1/2020 -12/31/2020 $13.58 $344,660.40 $28,721.70

1/1/2021 -12/31/2021 $13.92 $353,289.60 $29,440.80

1/1/2022-12/31/2022 $14.26 $361,918.80 $30,159.90

ADDITIONAL RENT:

”Tenant’s Complex Proportionate Share” shall be (i) 3.3% (calculated by dividing the number of rentable square feet in the Additional Premises (25,380) by the total

number of rentable square feet in the Complex (775,213) through and including the Additional Premises Expiration Date.

“Tenant’s Tax Contribution” shall mean Tenant’s Complex proportionate Share of Taxes assessed against the Property.

Note to additional rent: Most of the buildings have been demolished as of 2/1/2017. Ownership based the Real Estate taxes and CAM on the previous percentage amounts.

Utilities are a direct charge.

Options to extend: Tenant has two five year options to extend with 90 days prior notice. Additional rent shall be mutually agreed to by the parties. In any extension the tenant

is not entitled to any free rent, rebates, tenant improvements or other concessions.

Ownership negotiations and future use: Curtiss Wright conducts confidential Navy equipment testing in this facility. Ownership will need to incur additional expenses in order

to bring electric to the Curtiss Wright building at the current capacity. Ownership discussed a ten year extension which Curtiss Wright ultimately rejected. There have also

been discussions to terminate the lease. Curtiss Wright will be using the facility for testing purposes in September of 2017 through first quarter of 2018. Curtiss Wright is

evaluating the possibility of relocating the highly specialized facility after that testing period. The parking, square footage and access to the remaining I-78 Logistics Park would

be greatly enhanced if Curtiss Wright were to leave the site. Their lease however predates any bankruptcy and they have a binding SNDA in their lease. The tenant and owner

are in regular communication regarding their testing time frames and the evaluation of future use of the facility.

40 I-78 L O G IS T IC S P A R K